Plus, interest in these accounts is compounded daily. Higher APYs: Since high-yield savings accounts have higher APYs than traditional savings accounts, you’ll accrue more interest over time.

You can use our tool, in partnership with Bankrate, to compare savings rates today. Since the rate of return on high-yield savings accounts is better than that of traditional savings accounts, you'll be able to accrue more cash over time. Over time, rates will decrease as inflation cools. Higher interest rates could potentially increase savings rates further, so many recommend locking in rates now while they're on the rise. Experts believe that the Fed may raise rates again at the next meeting. The Fed opted to raise rates at the last meeting, raising the federal funds rate, a key bank lending rate, to a target range of 5.25%-5.50%.

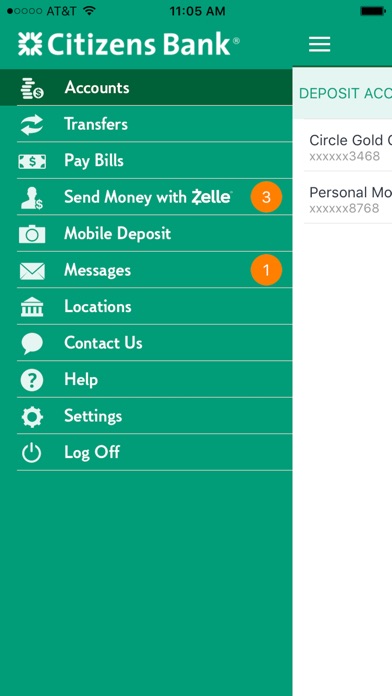

CITIZENS BANK ONLINE ACCOUNT SERIES

Savings rates have been on the rise following a series of interest rate hikes by the Federal Reserve, as the central bank has sought to reduce inflation.

The APY for high-yield savings accounts can be anywhere from 3% to over 5% - much higher than that of a traditional account. An APY, or annual percentage yield, is the amount of interest earned on an account in one year. A high-yield savings account is essentially the same as a traditional savings account with one key difference - high-yield savings accounts pay a higher than average APY on deposits.

0 kommentar(er)

0 kommentar(er)